The Hasbro Q3 2023 Earnings - Star Wars In Decline

Early this morning Hasbro released their numbers for the 3rd quarter 2023. So how are things? Chris Cocks sees the company right on track because of his excellence initiative. In reality investors are not happy and at the time of writing this article Hasbro’s stock price is rapidly declining, it’s currently about 10% lower than yesterday, at roughly $49 now.

Why is that? Well, it turns out consumers value other things much more than toys in times of high inflation. And Hasbro also warned that things will not improve for the holiday season. In fact, analysts expect the toy market to shrink in 2023.

And what about Star Wars? Star Wars (and Marvel) were not mentioned even once in Hasbro’s report. Which is usually never a good thing to begin with. But based on the numbers and information provided in the earnings call one can say without a doubt that sales are shrinking by quite a bit. Click through for more about that!

First some very basic numbers: revenue in Q3/2023 is down by 10% compared to the same quarter last year, to now $1.5 billion. Year to date, i.e. the first nine months of the year, revenue is down by 11%, or $3.7 billion.

Hasbro reported a net loss of $171 million, year to date the net loss amounts to $428 million. And the year is not over yet. So the company could realistically lose $600 million in 2023 when all is said and done.

Wizards of the Coast and Digital Gaming ( Magic the Gathering and Dungeons & Dragons) is still a money printing machine for Hasbro, and in Q3 the raging success of Baldur’s Gate 3 greatly contributed to even more revenue, because Hasbro of course receives licensing fees for the game. Hasbro reports a 40% increase in this segment compared to the prior year. And as far as digital gaming is concerned the mobile Monopoly game is a raging success as well.

The eOne segment, soon to be sold, is currently like a giant stone dragging down the company. That segment alone reported a loss of $486 million (meaning, the other segments are profitable), this is in part because of the writers guild and SAG strike in Hollywood and with costs involving the upcoming sale of the business. It turns out that Chris Cocks may actually have made the right call when he decided to make Hasbro a toy company first again and to get rid of the entertainment branch. Predecessor Brian Goldner wanted to turn Hasbro into a multimedia company, but it seems toymakers may not be good content producers. That being said Mattel actually accomplished what Hasbro would have liked to accomplish, their Barbie movie was a huge success. But none of the Hasbro produced movies made an impression and Dungeons & Dragons earlier this year flopped at the box office.

Chris Cocks was full of praise for his excellence program in the report and also in the earnings call. According to him the company is on track. But then again, the very important consumer products segment (all the board games, action figures and other toys that are not Wizards of the Coast) is rapidly shrinking, sales have declined 18% for the quarter and 17% year to date.

Chris Cocks blames “soft industry trends”. CEOs and their euphemisms.

Ok, on to Star Wars and action figures then. Star Wars was not mentioned even once in the report, and only briefly mentioned in the earnings call. So we have no direct information about the performance of the brand other than that sales are declining, which is the only thing Hasbro admitted. However, the numbers released combined with the few statements made do shed some more light on the situation.

Partner brands revenue (the segment where all the licensed toys are bundled, so Star Wars, Marvel etc) keeps declining. A whopping 35% decline was reported for Q3 and a no less whopping 31% for the year to date.

Hasbro then admits that only roughly half of that decline can be attributed to exited licenses, in other words, the other half is a result of declining sales for the remaining licenses, that is Star Wars and Marvel and a few other things. And Chris Cocks referred to what Star Wars and Marvel are experiencing right now as a “retrenchment”. He could have said “toy sales for Star Wars and Marvel are declining”.

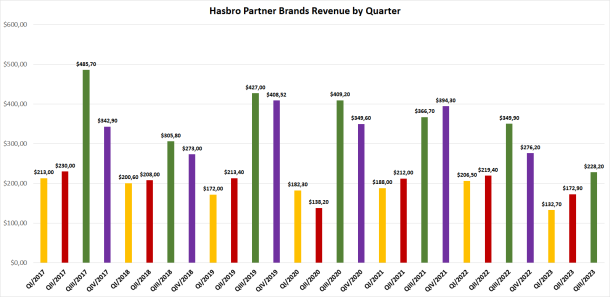

To illustrate how bad things are currently here a bar chart of quarterly partner brand revenue going back to 2017:

The quarters are color coded and generally speaking Q3 is the strongest quarter for Hasbro, because retailers stock up for the holiday season which drives sales. The green bar is for Q3 and as you can see revenue is rapidly declining. Now remember that two or three years ago action figures were a lot cheaper, Hasbro raised prices by $5 or more even since then. It’s easy to see what that means for actual unit sales.

In fact, the numbers reported in 2023 are even worse than for 2018, which was the absolute low point until now, fresh on the heels of The Last Jedi and Solo, the perfect double punch that subsequently ended all grandiose movie plans by Disney.

Now going one year back Hasbro was proud to report that Star Wars (and Marvel) were showing growth, before everything collapsed in Q4 which was the starting point for Hasbro’s woes. But even back then the question was how much of that growth is down to the price hikes and how actual unit sales were affected by it.

Another clue we have is how much Hasbro spent on royalties, which means how much money they paid to companies such as Disney. In Q3 Hasbro spent $107 million on royalties. Which is down by 21% compared to the previous year. Again, it is impossible to say how much the exited licenses contributed here, but much lower royalty costs combined with much lower partner brands revenue and the fact that the earnings report cites “lapping strong entertainment in 2022” and “soft industry trends” and the fact that only 50% of the revenue decline can be attributed to exited licenses paint a pretty clear picture: sales must be down. By quite a bit.

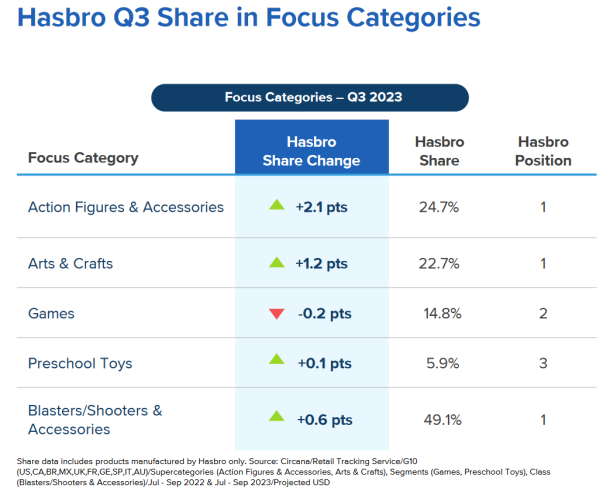

For the first time ever though Hasbro revealed an interesting tidbit about their market shares:

As you can see Hasbro actually gained market share in the action figure segment and roughly one quarter of all action figures sold are Hasbro action figures, making them the leader in that segment. Despite a higher market share the overall segment is shrinking however. As mentioned previously consumers are prioritizing other things in times of high inflation and economic insecurity, so paying rent, buying food and other necessities of life are of course more important than buying toys you don’t really need.

So to blame the bad numbers on Star Wars or Marvel entertainment alone would be wrong. A combination of factors is at work here: Chris Cocks’ ambitious plan to increase profit margins resulted in price hikes to begin with (profit margins are still what they used to be though, about 13%, Cocks is aiming for 20+%, but that was before inflation ruined his plans), this was further exercebated by high inflation which also contributed to even higher prices and cuts on production and development costs. But when the necessities of life become ever more expensive you cannot spend as much money on inessential knickknacks anymore. So Hasbro is scrambling to somehow protect their margins, but price hikes and cost cutting can only help so much with that when consumers stop buying your toys.

That being said both The Mandalorian season 3 and Ahsoka (retailers would have placed their orders for Ahsoka figures in Q3) failed to give the toyline a boost. Of course the pfp box design also has to be mentioned here. There is certainly a reason Hasbro performed a 180 degree turn after about 12 months on their decision to release action figures in cardboard boxes without windows or any means to see what’s actually inside the box.

One other thing: Pulse is thriving, Hasbro calls it a medium sized business, so it’s probably not contributing all that much, but direct to consumer sales increased by 57% in Q3. Pulse is of course a good thing for Hasbro, they cut out the middleman and don’t have to sell at wholesale prices to Walmart or Amazon, they demand the full MSRP from consumers instead. So a figure sold on Pulse will inevitably be more profitable for Hasbro.

So what can we say? It’s very safe to assume that Star Wars toy sales are declining, though not explicitly stated Hasbro did admit that about 50% of the partner brand decline can be attributed to the licenses they still own, the other 50% is down to exited licenses. By how much Star Wars toy sales declined we cannot say, but chances are high that sales are collapsing. This is not entirely the fault of Lucasfilm and Disney or even Hasbro (to a lesser degree), because the entire segment is seeing an industry wide decline (that being said Hasbro reported growth for both their own Transformers and GI Joe brands, in fact Transformers sales are up by 30% even!) and not just action figures, but the toy market overall is expected to shrink in 2023. Hasbro and all the other toy companies are facing a strong headwind in times of high inflation and increased costs for everything. Mattel is also under pressure, even though their earnings report was much more positive than Hasbro’s but Mattel too warned of a weak upcoming Q4 and current industry trends.

And finally: when your revenue is shrinking rapidly despite much higher prices it only means one thing: you are losing customers, fast. Unit sales must be even more affected. In 2020, the first year The Mandalorian and Grogu really turned around things, partner brands revenue was almost double of what we have now. But back then figures were $5 (or even more) cheaper still. With a roughly 25-30% price hike for action figures since then Hasbro only makes 56% of the money they made with their partner brands in 2020. Based on an average price increase of $5 it may as well that Hasbro’s action figure unit sales have collapsed by 60+% since 2020. And this is the real problem: how do you win back customers who no longer buy your toys? A while ago Chris Cocks revealed in an interview that the hardcore collectors are still happy buying overpriced toys, but the casual consumer not so much, more like not at all. Can Star Wars survive on catering to hardcore collectors alone? Incidentally this is also a question Lucasfilm must ask themselves after Ahsoka, a series made for hardcore fans, because Ahsoka’s ratings are also down by quite a bit compared to The Mandalorian, Obi-Wan Kenobi and even The Book of Boba Fett. And the fact that Chris Cocks cites “entertainment” as one reason for the “retrenchment” of both Marvel and Star Wars is telling. Again, earlier this year we had The Mandalorian, only the most successful series on Disney+. But that apparently did not translate into toy sales. In fact, it didn’t even translate to higher subscriber numbers for Disney+, the service lost 300k subscribers in North America alone that quarter. Walt Disney will release their numbers in early November. We will reconvene then.

Hasbro Q3 earnings report

Hasbro Q3 earnings presentation (PDF)

Hasbro Q3 earnings call transcript (Seekingalpha)

Related Links

Category: Hasbro, Toy Industry News

Previous Article: Review: Artoo-Detoo (R2-D2) - TBS6 [ROTJ40]

Next Article: Review: Luke Skywalker (Jedi Knight) - TBS6 [ROTJ40]

-Click HERE to return to the home page-